I. Market overview

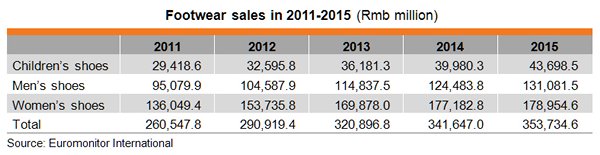

As the disposable income of China’s huge population continues to rise year after year and consumer demand for footwear of higher grades grows, sales in China’s footwear market are not only enormous but are increasing steadily every year. According to the projection made by Euromonitor, in the next few years China’s footwear market will continue to grow at an average rate of 7%. A market survey conducted by Euromonitor estimates that sales in China’s footwear market in 2016 amounted to Rmb370 billion.

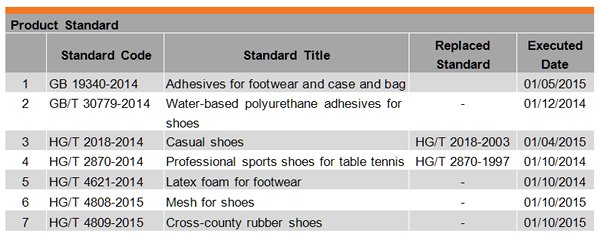

Table: Footwear sales in 2011-2015

Leather shoe market: Office workers are major consumers of leather shoes and they are now placing more emphasis on the design and styles of leather shoes. It is interesting to note that male and female consumers have totally different ideas when it comes to buying shoes. Men tend to attach more importance to traditional designs while women give more attention to trendiness. Generally speaking, the average number of pairs of shoes owned by female consumers is more than that owned by males.

According to a consumer survey on China’s leather goods market conducted by the Hong Kong Trade Development Council (HKTDC) in 2013, the characteristics of footwear consumption on the mainland can be summarised as follows:

Leather shoes are probably the most popular leather goods and yet their rate of wear and tear is also the fastest. In the 12 months prior to the survey, almost all respondents (84.9%) have bought leather shoes, averaging 2.8 pairs. Both the proportion and average number of leather shoes bought in cities in eastern China are slightly higher than those in other regions.

To over 56% of the respondents, the most preferred leather material is sheepskin (lambskin), followed by cowhide (47.3%) and suede (26.9%).

In the 12 months preceding the survey, the average spending of the respondents on each pair of shoes was Rmb1,075. The average spending of people in cities in eastern China was the highest, reaching Rmb1,236.

Consumers visit leather goods stores frequently. Nearly 80% of the respondents visit these shops at least once each month, mostly during weekends or public holidays.

Where sales channels are concerned, over 50% of the respondents indicate that department stores are the most popular places for purchasing leather goods. Hong Kong companies wishing to set up new sales outlets may consider marketing their products alongside other leather goods brands in the same department store.

Sports shoes market: Sports shoes can be classified into general sports shoes, professional training shoes and professional sports shoes according to their performance. The most common types include sneakers, travelling shoes, basketball shoes, football shoes, tennis shoes, skating shoes, hiking shoes, air sports shoes, and skateboard shoes.

As sporting events are becoming more and more popular and people’s awareness of fitness continues to increase, sports consumption has formed an integral part of people’s spending. Among all items, sports shoes are the most important with strong brand effect. In recent years, apart from such brands as Nike, Adidas and Li Ning, domestic brands including 361 Degrees, Peak, Anta, CAN•TORP and XTep have been growing strong and developing fast, particularly in second- and third-tier cities.

China’s outdoor market enjoys rapid growth in recent years as consumers are increasingly keen to take part in outdoor activities for the sake of both their physical and mental health. Meanwhile, the outdoor sports shoes market on the mainland is carved up by domestic, international and cross-sector sports brands. Product-wise, multi-functional outdoor shoes are very popular while performance-oriented hiking and walking shoes also sell well.

Leisure shoes market: As the concept of “leisure” is getting more and more important in the lives of Chinese consumers, the market for leisure shoes is also growing rapidly.

“Trendiness” and “comfort” are the two main selling points of leisure shoes. Consumers of leisure shoes are mainly aged between 18 and 45, with students and office workers forming the mainstay. They are more demanding where brand culture and individuality are concerned.

Slippers market: Following the diversification of footwear trends and development of urban leisure, slippers are presenting themselves to consumers in novel forms. They have gradually evolved from being a traditional item to be worn at home to a fashionable item embracing the taste of modern urban trendsetters. As such, sales of “outdoor slippers” led by leisure slippers and fashion slippers have been growing rapidly.

Children’s shoes market:

There are around 16 million new-borns on the mainland every year. With the post-80s and post-90s reaching their child-bearing age, a new wave of demand for novelty children’s shoes has spurred market development and generated new business opportunities.

In recent years, leading children’s footwear brands have been attaching increasing importance to product quality. Meanwhile, children’s footwear enterprises are placing greater emphasis on producing healthy shoes. Elements such as the style, quality and comfort of shoe products directly influence the buying decision of consumers.

Various adult footwear brands have made their way into the children’s market in recent years. In addition to popular international brands such as Nike and Adidas, Chinese brands including Li Ning, Anta, 361 Degrees and Xtep have also entered the children’s garment, footwear and accessories market. Apart from developing new profit growth areas, fostering future customers is also a main purpose of these domestic brands.

Keen competition has led to the segmentation of the children’s shoes market. Industry players are striving to expand market shares with continual improvement in their products and services.

As the “low-carbon, eco-friendly” trend is arousing more and more public attention, various brands in the footwear industry are launching “low-carbon society” campaigns, with some of them introducing low-carbon product series featuring green raw materials, energy conservation and recyclability in a move to enhance their brand to attract consumers. Examples include low-carbon shoes, low-carbon green sports shoes, and low-carbon leisure shoes.

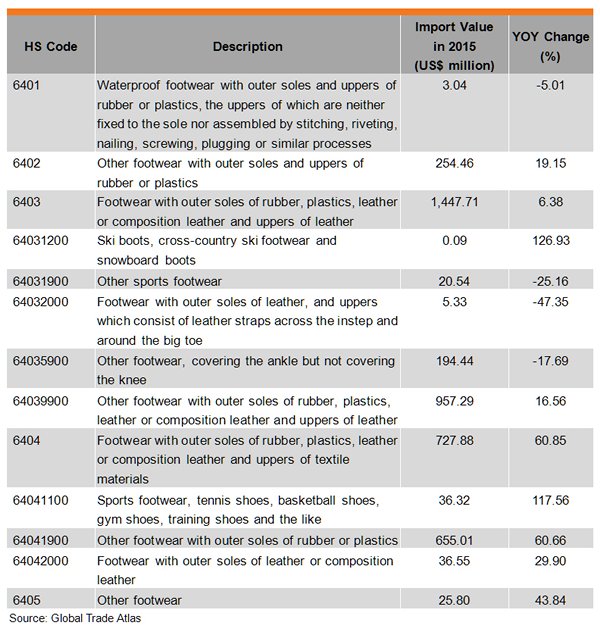

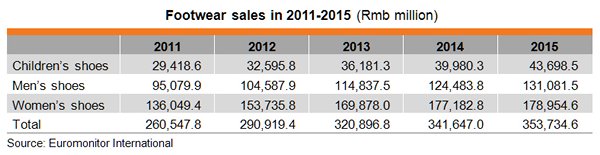

Imports of selected footwear products in China in 2015:

Table: Imports of selected footwear products in China in 2015

II. Market competition

In the mainland footwear market, domestically-made shoe products are the dominating force. All in all, there are currently four major footwear industry clusters in the country, located mainly in the southeast coastal regions. The first is the Guangdong footwear industry base led by Guangzhou and Dongguan, with medium to high-end shoes being their major products. The second is the Zhejiang footwear industry base led by Wenzhou and Taizhou, which mainly produce medium to low-end men’s shoes. The third is the western region footwear industry base led by Chengdu and Chongqing, where medium to low-end women’s shoes are primarily produced. The fourth footwear industry base is led by Quanzhou and Jinjiang in Fujian, with sports shoes being the main products.

Competition in the mainland footwear market exists in three segments. First, import brands, which mainly come from the US and European countries such as Italy and Spain and they dominate the high-end market. Second, brands of Sino-foreign joint-venture enterprises, which mostly come from Hong Kong and Taiwan and, with their financial strength and design ability, they account for the lion’s share of the medium-range market (however, in recent years, some domestic brands have also successfully established a presence in this market segment). Third, brands produced by the multitude of local manufacturers which occupy the low-end market.

More and more footwear enterprises have begun to devote great efforts to enhancing their technological and innovation capability in a bid to stay competitive and move further towards specialised production. Hence, it can be expected that new technology, new materials and new processes will see more application and development in the footwear industry. This will in turn propel the mainland footwear market to develop further in such areas as trendiness, superior quality and reasonable pricing. Meanwhile, enterprises which compete on costs will relocate their production to places that offer more competitive advantages. The footwear industry in Wenzhou, for example, has begun shifting to the western region of China.

While international brands have already penetrated the China market, many domestic enterprises are also starting to build their brands. A number of reputable local footwear brands have thus emerged, including Li Ning, Belle, Aokang, Anta and XTep. It is estimated that the market share of domestic brands continued to rise in 2015, due partly to the strategy of mass-market pricing and expansion to less developed cities. That said, international brands still reported steady sales growth thanks to the rising income levels of mainland consumers.

Intensifying competition has led to further segmentation of the market. All along, well-known international and domestic sports shoes brands have been focusing their efforts on adult products. But as competition grows increasingly steep, the market becomes further segmented, which in turn provides industry players with more room for market development. Some well-known international and domestic brands are adopting the segmentation strategy in a move to capture a bigger market share. This means footwear products will become more personalised and specialised and competition within the segmented market is set to heat up even further.

Southeast Asian countries are gradually catching up with China with greater labour cost advantages and improving industry chains. However, as the capacities of these countries are limited and their industry chains have yet to be fully developed, China can still maintain its status as the world’s

factory for the time being. To boost competitiveness and create business opportunities, Chinese footwear enterprises have stepped up

cooperation efforts with their Southeast Asian counterparts. To this end, the China-ASEAN Footwear Industry Cooperation Committee was formed on 8 June 2013.

III. Sales channels

Department stores, large shopping centres and warehouse-style shopping malls remain the leading footwear retail channels in China. Meanwhile, specialty stores and franchised stores have also been growing fast in recent years. The advantages of specialty stores include guaranteed brand image of footwear enterprises, fast capital return, and prompt and effective customer feedback. Their disadvantage is uniformity of products and brands. Despite that, many companies still use specialty stores as their sales channels, examples include famous brands Le Saunda and Aokang. Specialty stores are now a common sight in the mainland. In northern cities where consumers have the habit of frequenting department stores, footwear brands mainly adopt the shop-in-shop format to sell their products in this region.

In Wenzhou, the “footwear capital” of China, local trade associations have established a one-stop footwear products and services platform as a means to promote the city’s footwear material and footwear manufacturing industry. The complex, named “China footwear and footwear material city”, has by now drawn in more than 500 tenants which have already started business. With a huge variety of footwear and footwear materials on offer, many of which are from famous brands, the shoe city attracts buyers from all parts of China and abroad. Such innovative marketplace can serve as a central trading platform and contribute to the sustained development of Wenzhou’s footwear sector.

Currently many manufacturers have started to shift their product sales to hypermarkets where different types of shoes under different brands are grouped together and offered for sale under one roof. By so doing, they are replacing single-brand specialty stores with diversified hypermarkets. Well-known brands usually sell their stocks at lower prices at hypermarkets, targeting the middle-aged and younger consumers.

Chain sales have a strong competitive edge in the footwear industry. Large-scale chain operation is becoming a popular business model adopted by many footwear enterprises. Examples include Zhengdahua of Shenzhen and Darloro of Guangzhou.

The footwear industry is making its way into the emerging e-commerce market.

In August 2010, China’s shoe website, www.cnxz.cn, launched an online wholesale mart jointly with a great number of mainland footwear enterprises. This online wholesale mart, operating in the form of online shops, fully integrates the rich resources of the supply, demand and value chains of the country’s online and offline footwear industry players and provides a comprehensive business platform for footwear enterprises and traders by offering such services as specialised online display, brand promotion, online marketing, business matching and industry information dissemination.

In April 2015 e-commerce giant Alibaba launched the “made with good quality in China” campaign jointly with local quality supervision departments and industry and trade associations. A number of the home-grown footwear brands were featured on Alibaba’s retail platform during the campaign.

Survey findings show that products most commonly bought by mainland consumers online are garments, footwear and headgear. Normally online shops would list the sizes of their products in detail and would display the products in colour photos. Since most of the online garment and shoe shops offer free service of goods return, consumers can always make a purchase first and return the goods after they have received them and found them unsuitable. Some mainland consumers point out that as the number of physical stores selling garments and shoes is too big and the product styles offered are ever changing, it is impossible for them to visit each and every shopping mall and store to pick their favourite product. By contrast, online search engines can help consumers find what they want easily and quickly. They can also find out about the strengths and weaknesses of the products from user comments.

Leading footwear marts housing large numbers of manufacturers and suppliers are important wholesale trading platforms for footwear products in the mainland. Examples include the footwear commercial district on Guangzhou’s Zhanxi Road, Hehuachi footwear wholesale mart in Chengdu, shoe city in Wenzhou and Pacific shoe city in Changchun. Nowadays, the specialised footwear wholesale marts in various large cities are going upmarket and moving towards large-scale operation. This development helps to effectively enhance the grade of fashionable footwear and their influence on consumption. This can in turn attract more visitors to the marts and increase sales.

Trade fairs held in various places in China have become the best channel for enterprises to acquire the latest information on the development of the mainland footwear market.

Table: Selected footwear and related products exhibitions in China

IV. Import and trade regulations

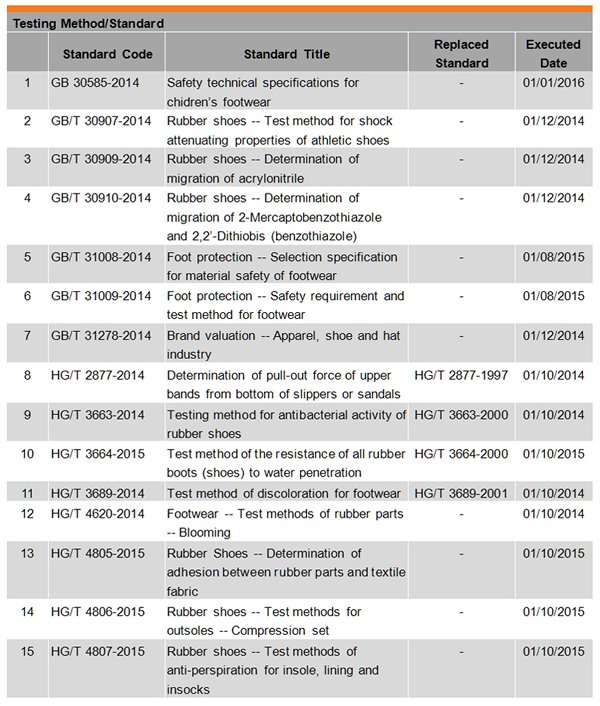

Foreign companies wishing to enter the China footwear market should take note of the relevant standards in the mainland. Under the Standardisation Law of the People’s Republic of China which came into force on 1 April 1989, there are four sets of standards with their effectiveness in descending order, namely national standard, industry standard, local standard and corporate standard. National standards are classified into mandatory standard and recommended standard, their standard codes are GB and GB/T respectively. Industry standards are also classified into mandatory standard and recommended standard, their standard codes are QB and QB/T respectively. Footwear falls under light industry. Local standards are mandatory standards enforced in administrative regions; while corporate standards apply internally within an enterprise. For enquiries on relevant standards, please visit the website of the Standardisation Administration of the People’s Republic of China.

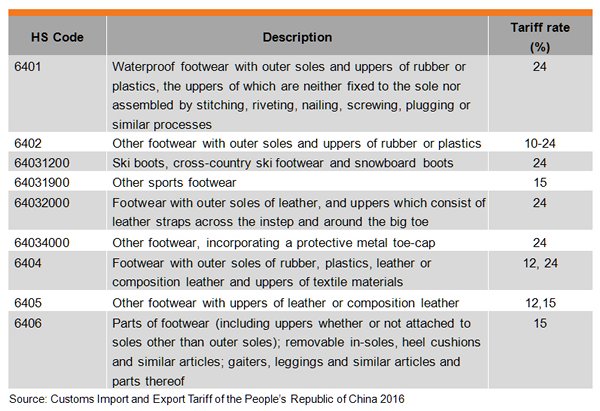

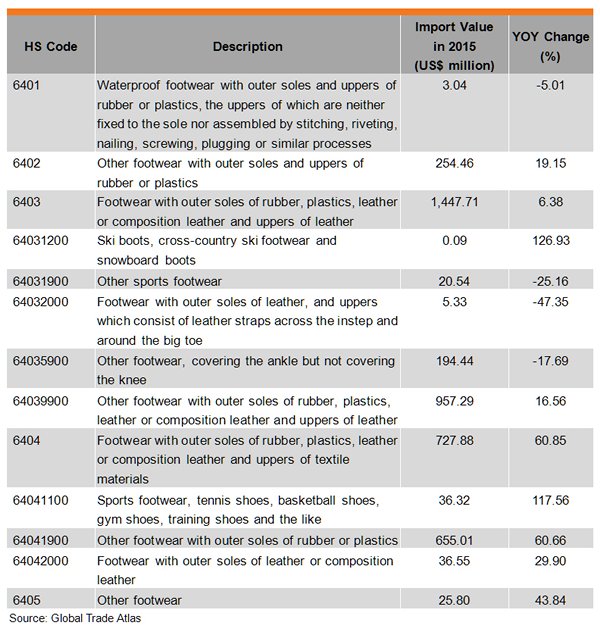

In 2016, the tariff rates levied by China on selected imported footwear products are as follows:

Table: Tariff rates levied by China on selected imported footwear products in 2016

Under CEPA, on principle, all Hong Kong products manufactured in compliance with the rules of origin can enter the mainland market at zero tariff. As such, footwear products are entitled to zero tariff and Hong Kong companies stand to benefit from this arrangement in tapping the mainland market.

Starting from 1 May 2011, a new set of standard, Rules for the Inspection of Footwear (SN/T 1309.1 – SN/T 1309.7 series), has been applied to the inspection of China’s footwear imports and exports.

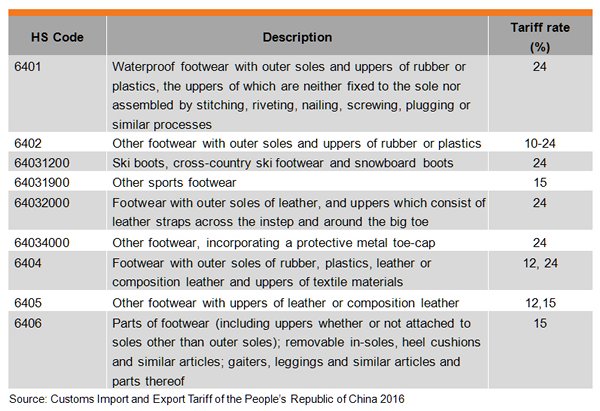

China has updated certain footwear product standards and related testing methods, as shown in the table below: